Investing in Singapore: I Just Did Cash Top-up My CPF Account And Why You Should Consider Doing It Too!

Here’s the benefits: higher interest rates and tax relief.

There are ways to do investments. Buying properties and precious metals such as gold, buying stocks, bonds, contributing to IRAs, Roth IRAs, 401(K) and many more. The last 3 things I mentioned, IRAs, Roth IRAs and 401(K) while you may often hear news about them, they are unfortunately only applicable for US-based citizens.

Disclaimer: I am not a financial expert nor a financial savvy person nor financially educated. I’m sharing this based on my own experiences and my limited knowledge in financial world. Do bear with me and my financial literates and should you choose to follow whatever I’m about to tell you here, do it at your own risk! I won’t be held responsible for any loss/damage it may incur to you.

CPF – IRAs / Roth IRAs / 401K for Singapore Residents

For Singapore residents, however, there’s something similar to those 3, it’s called CPF managed by CPF Board. CPF itself is short for Central Provident Funds – a government initiatives funds used for housing, investments, educations, medical as well as retirement plans for Singapore people.

While IRAs, Roth IRAs and 401K are optional, CPF is mandatory for any Singaporean and Singapore Permanent Residents. Every months, anybody with CPF account and consider working in/under Singapore is required to get 20% deducted from their salary to fund their CPF. This 20% salary cut goes into 3 sub accounts under CPF account: Ordinary Account (OA), Special Account (SA), and MediSave Account (MA).

CPF OA vs SA vs MA – What are they?

I won’t go into details explaining these 3 accounts, but these 3 are:

- Ordinary Account (OA) is mainly used for housing installment payments. Other usage is for paying insurance and education.

- Special Account (SA) is for old age savings and is used to form part of members’ retirement sums when they reach 55 years old. Other usage is for investing in retirement-related financial products.

- MediSave Account (MA) is meant to help CPF members save for their personal or immediate family’s hospitalization expenses, certain outpatient expenses and approved medical insurance.

What Make CPF Interesting: Its Interest Rates!

What makes CPF interesting is the fact that Singapore government gives (considered) generous interest rates on CPF accounts.

Here are the interest rates gained on your CPF account at the time this article is written:

- Ordinary Account (OA) interest rate is minimum at 2.5% and up to 3.5% per annum.

- Special Account (SA) interest rate is minimum at 4% and up to 5% per annum.

- MediSave Account (MA) interest rate is like SA, minimum at 4% and up to 5% per annum.

FYI, CPF Board reviews the rates quarterly and will make adjustment depends on the (economic) situation, but rest assured CPF Board will always try to make the interest rates exciting and higher than any of major local banks interest rates.

For latest CPF interest rates, do check the following link: https://www.cpf.gov.sg/Members/AboutUs/about-us-info/cpf-interest-rates.

What is CPF Cash Top-up? Is It the same as RSTU?

Enough with the introduction, now back to topic: CPF Cash Top-up. It’s basically topping up your CPF account using cash – mainly the Special Account (SA) – for age below 55, or Retirement Account (RA) – for those with age 55 and above, which government dedicated these accounts for your own and family retirement. In fact, Singapore government has the programme called RSTU – Retirement Sum Topping-Up scheme. So yes, CPF Top-up and RSTU are pretty much the same, though I should say CPF Cash Top-up is one part of RSTU.

Why I did Cash Top-up my CPF and why you should consider doing it too?

Before reaching my 31st birthday, believe it or not, I didn’t really have investment plan and I wasn’t an investment minded person. All of my salary I got: 1) I used to buy gadgets, 2) I used to go travelling with my wife, 3) while the rest I kept them on single bank account. I didn’t even have any fixed deposits nor stocks, bonds and those things. I barely knew them. My life back then was simple (and ignorant): earned money as much as you can, get married, buy a house, buy a car, have kids, live your life.

But ever since I reached my 31st birthday, so many things have changed. I got my eyes opened to the investment world and from that moment I knew how I was so lagging behind. In this life, earned money as much as you can is not enough. The hard-earned money will always get depreciated, thanks to the inflation. Your $1 today will have less value in the future.

Thanks to my wife, partly for opening my eyes. Long story short, from that point onward, I have learned so many things about investment and how to invest – did a few trial and error (see my article for Bitcoin investment here, and my article for buying my first stock here).

Fast forward to today, after days and hours of researching and reading here and there and did few rounds of discussions with my wife, as part of my investment plans, I decided to do CPF Cash Top-up.

As you can see from the interest rates mentioned above, their (CPF) interest rates are way above any interest rates from any major banks with their multiple savings products (savings account, current account, fixed deposit) can give.

So the main reason why I did CPF top-up is because of 2 things:

1) Its high interest – means I shall get more money from the interest – and

2) Getting tax relief. Yes a tax relief. As a way to boost its retirement savings programme, Singapore government is giving its residents a way to claim a tax relief in case you choose to top-up your CPF. Details about tax relief by topping-up your CPF can be seen here on IRAS official website.

As a reminder, I am not an investment savvy person, and I don’t have any financial background, and I don’t really have certifications related to finance. I have just started learning about investing and its various instruments, together with how to invest in the past one year only. So given my limitation, CPF top-up is one of the best choice to go.

If you are pretty much like me, you are not an investment savvy person and for whatever reasons you don’t really want to go deep into investment and their instruments, topping up CPF is one of the best choice you have as a Singapore residents, rather than keeping your money at the banks or worse under your pillow. But don’t do topping-up your CPF if you can find better place to invest and grow your money.

Find other awesome articles, tips, tricks related to Life and Tech, iOS and Android quick review on:

How to do CPF Top-up?

If you are still reading, I guess you are pretty much interested. So keep reading.

So how to do CPF top-up? Would it be super hassle? Well, turn out it’s very easy to be done. Even you can do it via your smartphone.

The following guides are done via smartphone, if you are using desktop computer while the processes are entirely the same, but you could see a bit different wording/menu. I tested myself, topping-up my CPF using a smartphone.

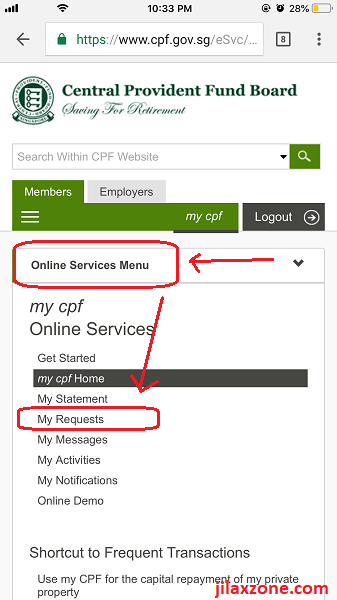

1) Open CPF website: https://www.cpf.gov.sg/. Login to your account via SingPass.

2) Under “Online Services Menu”, go and find “My Request”. Tap on it.

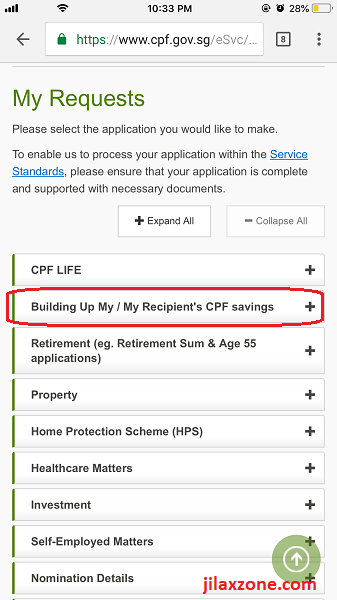

3) Inside My Request page, go and find “Building Up My / My Recipient’s CPF Savings” and tap on it.

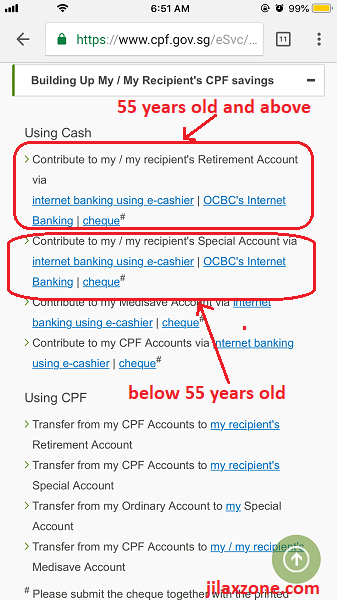

4) On the expanded menu and under Cash, choose one the following whichever suitable for you:

a) Contribute to my / my recipient’s Retirement Account via Internet Banking using e-cashier | OCBC Internet Banking | cheque –> choose this if you are 55 years old and above.

b) Contribute to my / my recipient’s Special Account via Internet Banking using e-cashier | OCBC Internet Banking | cheque –> choose this if you are below 55 years old.

Since I don’t have OCBC account, then I chose Internet Banking using e-cashier. Even if you have OCBC account, you can still choose Internet Banking using e-cashier.

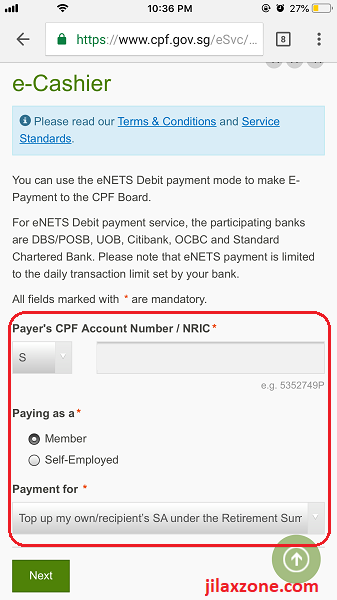

5) Inside the e-Cashier page, do fill in all the required information:

a) CPF Account Number / NRIC: fill in your NRIC.

b) Paying as a: choose between member or self employed.

c) Payment for: Choose “Top-up my / my recipient’s SA (Special Account)” if you are below 55 years old or choose “Top-up my / my recipient’s RA (Retirement Account)” if you are 55 years old or above.

Since I’m below 55 years old, I chose to top up my SA. Subsequent steps are based on topping-up SA. However I do believe topping up RA will more or less have the same steps.

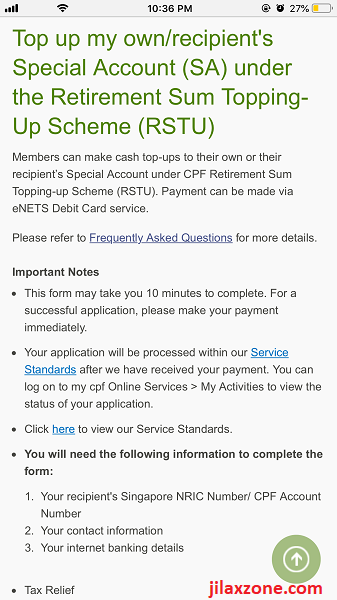

6) On the next page (depends on your choices), on my case “Top up my own / recipient’s Special Account (SA) under the Retirement Topping-Up Scheme (RSTU)”, is all about reading the terms and conditions. Do tick “I have read and accepted tbe Terms and Conditions above” if you are agree to the terms and conditions. And tap on “Start” to start filling in the necessary.

To note: topping-up CPF is irrevocable, means it cannot be refunded.

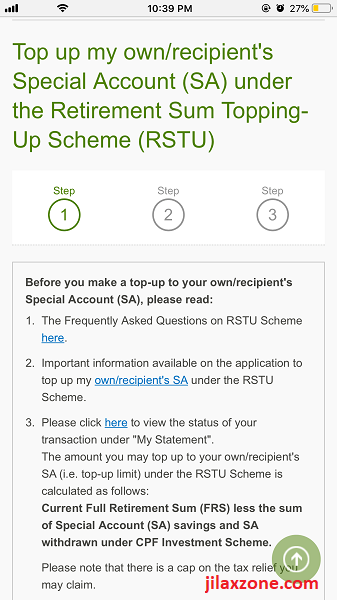

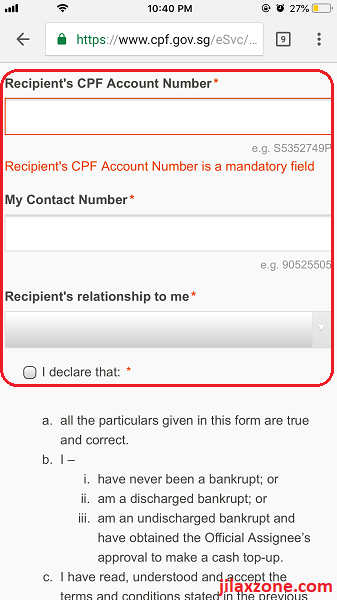

7) There are 3 steps to complete the process. On step 1, fill in the following and tap “Next” when done:

a) Recipient’s CPF Account Number: it’s the NRIC. If you are topping up for yourself, fill in your NRIC number.

b) My Contact Number: fill in with your contact number.

c) Recipient’s relationship to me: fill in “Self” if you are topping up for yourself. Otherwise choose accordingly.

d) Tick on “I declare that” once you have read and agreed to the statements.

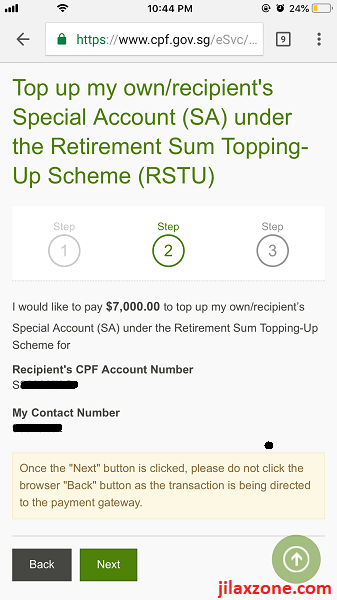

8) On step 2, all you need to do is just confirming whatever details you have filled and given on step 1. Tap “Next” if all the information is correct.

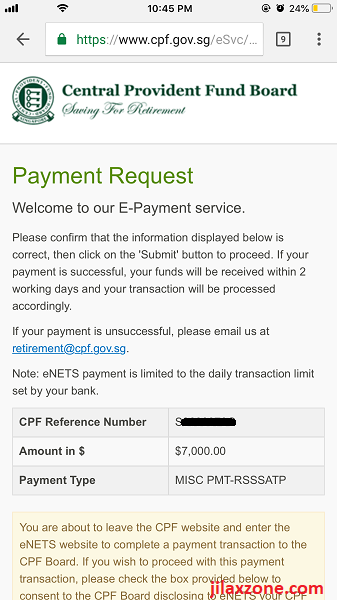

9) On step 3, you’ll be redirected to the Payment Request page. Again confirm on the details, and tick the box to give consent to CPF board. Tap “Next” once done.

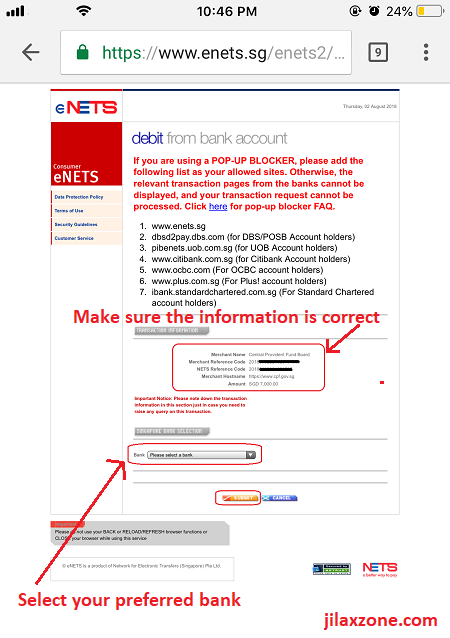

10) You’ll be redirected (again) to eNets page. Select your bank and tap on “Submit” button. Make sure the Merchant Name and Amount are correct before tapping Submit button.

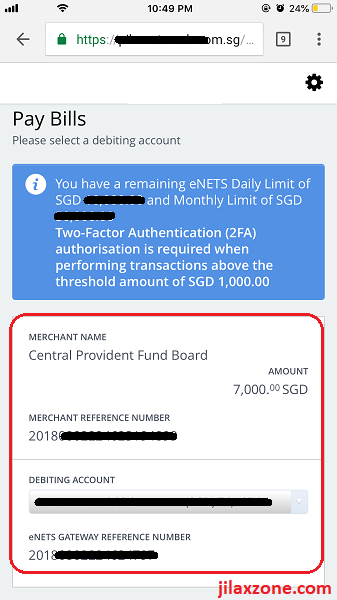

11) Depends on the bank of your choice, you’ll be redirected (again), this time to your bank website. Login and prepare the token if required. Before committing the transfer, again make sure the Merchant Name is Central Provident Fund Board and the amount is correct. Do confirm and submit your payment transfer. Take screenshot and take note on the transaction reference number (required in case there’s disputes).

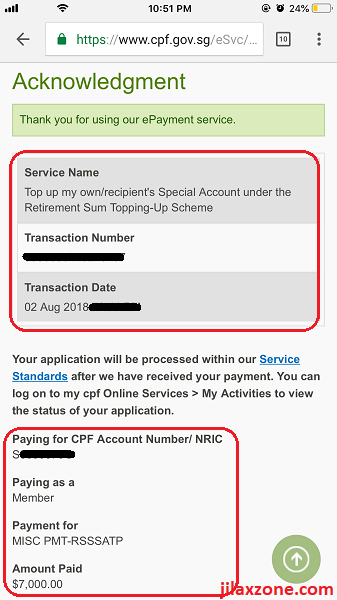

12) Once payment is submitted from your bank, you’ll be (again) redirected back to CPF Website. Wait until you’ll get redirected to their Acknowledgement page. Once in Acknowledgement page, do (again) take screenshot and take note on the Transaction Number (required in case there’s disputes).

You have just made CPF Top-up!

That’s it. You have gone through the heavy lifting part. Now what you need to do is to wait for at least 2 working days for the funds to be process and reflected to your CPF account. After 2 working days or so, do check on your CPF account, the amount being transferred should be reflected there.

When you should do CPF Top-up?

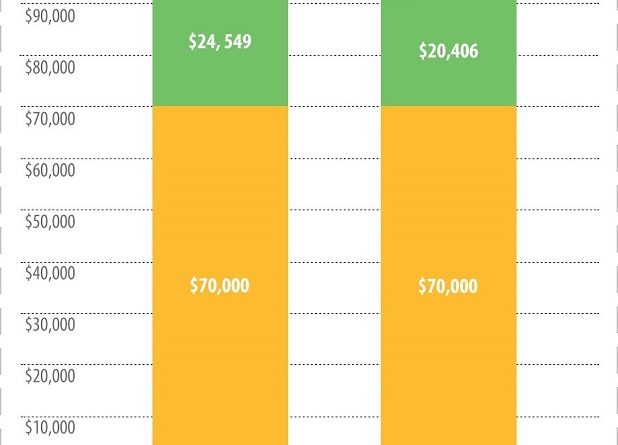

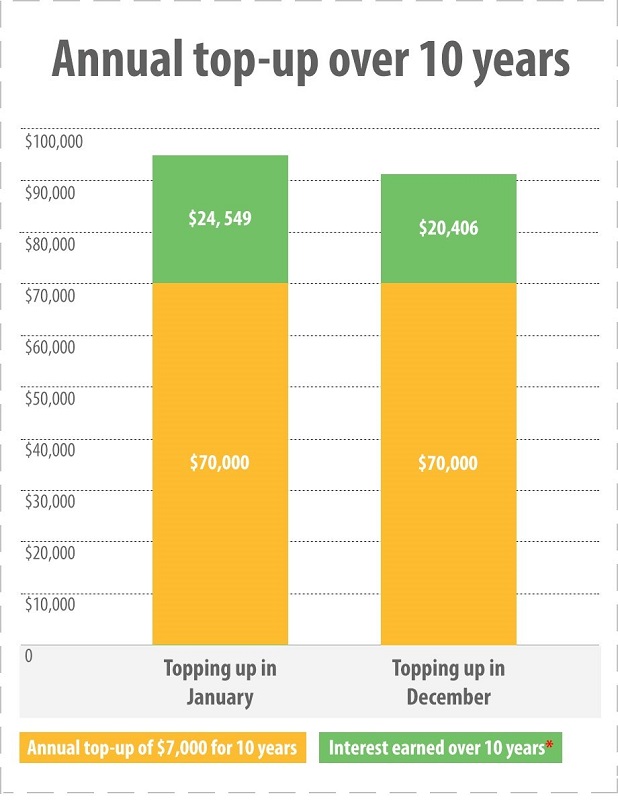

Government suggested to do CPF Top-up on January each year, where you can get the whole year interest rates to grow the money and to make sure you get the tax relief for the next year tax season (late submission normally leads to forgetfulness). See the illustration above, comparing between topping-up on January each year for 10 years compared to topping-up on December each year for 10 years.

While what government suggested is true, however you can top-up anytime in any days of the year – as long as you get the extra money for your future savings and retirement!

Things to note when doing CPF Top-up

While everything seems good, there are things to note when you are doing CPF Top-up.

1) The most important thing is, doing CPF top-up is irrevocable and non refundable. That means, you can not touch the money until at the time you retire (currently for Singapore residents, Government set at age 65). No matter how bad you need the money in the future (in case), you cannot take it back. Unless when you retire or dead.

2) If you are also chasing for the tax relief, do note that you won’t get tax relief if your tax relief amount is already reaching $80,000.

3) In case you are topping-up your spouse/parents/siblings CPF, you’ll only get tax relief if they have income less than equal to $4000/year. If they earned more than that, you are not eligible to claim a tax relief.

4) During tax filling season, although your cash top-up amount should automatically be reflected as part of tax relief, but don’t forget to check it out and in case it isn’t reflected as part of your tax relief, do add manually yourself.

CPF Top-Up: Bring It All Together

Do give your comments and thoughts and/or if you have queries/questions you would like to ask, down below on comment section.

For Life, Tech tips, iOS and Android Apps and Games quick review, do visit below:

Hi, thanks for reading my article. Since you are here and if you find this article is good and helping you in anyway, help me to spread the words by sharing this article to your family, friends, acquaintances so the benefits do not just stop at you, they will also get the same goodness and benefit from it.

Thank you!