Here’s how to withdraw SSB – Singapore Saving Bonds

TL;DR

- Find out how you can withdraw Singapore Saving Bonds using the detail steps provided on this article.

- In case you have queries, do ask on the comment section below.

- For more interesting article like this, head to Investing, Travel, Singapore and more at JILAXZONE.

Participate in Singapore Saving Bonds (a.k.a SSB) but finding out that you need to withdraw the money for whatever reasons – either you would like to use the funds for new, better return rate of another Singapore Saving Bonds or you would like to use the funds for even better investment somewhere else or simply you have plan to use the funds for catering your other needs, well whatever your reason is, I’ll have the step by step guide for you to withdraw the Singapore Saving Bonds.

Here are the step by step to withdraw Singapore Saving Bonds (SSB)

| Important Notes: a) Redemption period is between 7am to 9pm from 2nd to last fourth business day of the month or 6pm-9pm on the 1st business day of the month. b) Redemption is not available during public holiday. c) There is $2 fee on successful redemption. d) This guide is made as-is, to help you by providing the detail steps to withdraw Singapore Saving Bonds (SSB). I won’t be held responsible nor liable due to any issues or loss incurred. |

The steps are done based on commonly-used Bank in Singapore. For security reasons, I am not mentioning the Bank’s name here. In case you are using different Bank, the steps may be slightly different. But at least you get the idea on how to withdraw the SSB.

Step 1) Login to your Bank account and authenticate.

Step 2) Go to Invest > More Investment Services.

Step 3) Inside More Investment Services page, under Manage Investment, click on “Redeem Singapore Government Securities (SGS)“

Step 4) Inside Redeem Singapore Government Securities (SGS) screen, choose either “Singapore Saving Bonds (Cash)” or “Singapore Saving Bonds (SRS)” and click “Next”. If you are getting the error message telling “Redemption period is from 6pm-9pm on the 1st business day of the month and 7am to 9pm from 2nd to last fourth business day of the month”, then try again later during the mentioned business hours.

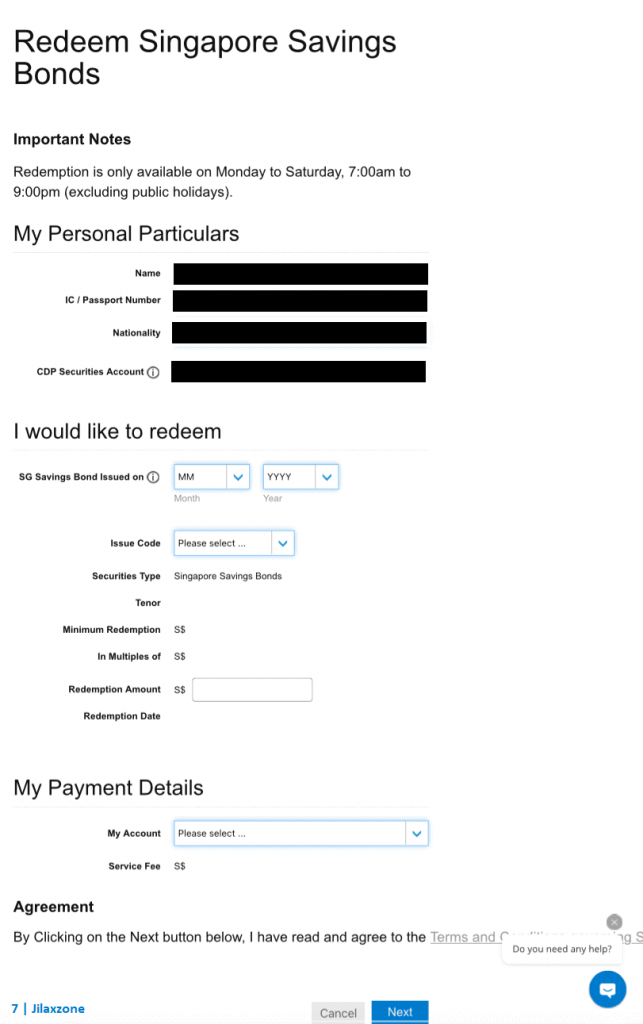

Step 5) Fill in the Personal Particular required.

Step 6) Fill in the Singapore Saving Bonds details and your account payment details. Do note that there are $2 fee when you withdraw your SSB. Click “Next”. In case you didn’t have the Singapore Saving Bonds details with you, do check on your CDP account. Get the Issue code, issue month and issue year.

Step 7) You’ll be redirected to a confirmation page. Check out all the details provided, especially your receiving account payment. Once everything is good, click on “Submit” to request withdrawal.

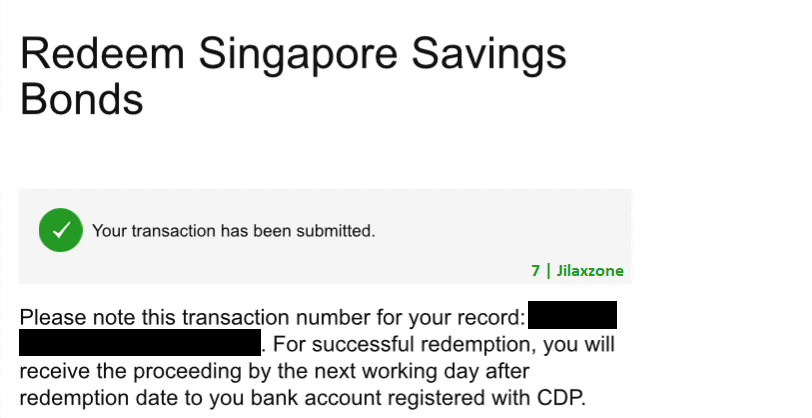

On successful withdrawal request, you’ll be given a Transaction Number. Do screenshot or take note on the Transaction Number given.

When are you getting the funds on successful SSB withdrawal?

The funds will not be transferred to your bank account straight away on the same day. On each successful withdrawal request, the funds will only be transferred on 2nd working day subsequent month.

So, if say, today is early September, once you submitted the withdrawal request, your funds will only be transferred on 2nd working day in October.

Bring it all together

Now you know how to withdraw SSB. More importantly, take note on when you’ll get the funds on successful SSB withdrawal, so you can plan accordingly. In case you have queries or are facing difficulties, don’t hesitate to put your issues or thoughts down below on the comment section. I’ll be happy to assist!

Interested to see other Singapore related tips and tricks? Check them out here: Singapore tips and tricks at JILAXZONE.

Do you have anything you want me to cover on my next article? Write them down on the comment section down below.

Alternatively, find more interesting topics on JILAXZONE:

JILAXZONE – Jon’s Interesting Life & Amazing eXperience ZONE.

Hi, thanks for reading my curated article. Since you are here and if you find this article is good and helping you in anyway, help me to spread the words by sharing this article to your family, friends, acquaintances so the benefits do not just stop at you, they will also get the same goodness and benefit from it.

Or if you wish, you can also buy me a coffee:

Thank you!

Live to Share. Share to Live. This blog is my life-long term project, for me to share my experiences and knowledge to the world which hopefully can be fruitful to those who read them and in the end hoping to become my life-long (passive) income.

My apologies. If you see ads appearing on this site and getting annoyed or disturb by them. As much as I want to share everything for free, unfortunately the domain and hosting used to host all these articles are not free. That’s the reason I need the ads running to offset the cost. While I won’t force you to see the ads, but it will be great and helpful if you are willing to turn off the ad-blocker while seeing this site.