Here’s how you can pay housing loan in lump sum using CPF – Singapore

- Find out how you can pay lump sum on your housing loan using CPF.

- In case you have queries, do ask on the comment section below.

- For more interesting article like this, head to Investing, Life, Travel, Singapore and more at JILAXZONE.

You have some amount on your CPF OA and decided to do lump sum payment or partial prepayment / repayment of your housing loan – especially because of the recent spikes in interest rate, but wondering how to do that? Well, you are on the right place here. Because I’m sharing on this article, a detail step by step how you can utilize your CPF OA to do lump sum payment of your housing loan. Should you have any queries after you read the step by step, don’t hesitate to put your queries down below on the comment section. I’ll be happy to assist!

More on articles related to CPF (such as what is CPF OA, how to invest using CPF and more): CPF tips and trick at JILAXZONE.

Step by step how to do lump sum payment (or partial prepayment) of housing loan using CPF OA

| Disclaimer: I’m not a financial expert. I’m just a person who happen to have a house with active housing loan. I won’t be held responsible for any potential gain or loss including losses/damages that may incur and/or occurred to you from reading and following what’s written on this article. The article is provided as-is based on my research as well as my own experiences on executing them. For you case: Do it on your own risk. |

Back when I wanted to do lump sum payment for my housing loan using CPF OA, I struggled during execution, because the option to pay housing loan in lump sum unfortunately is burried in the myriad of pages and links on CPF website – which perhaps for many are discouraging and end up not executing the lump sum payment. That’s the main reason why I wrote this article – with the intention of sharing the detail step by step to find the pay housing loan in lump sum option, so that you won’t get discouraged but rather encourage to execute it.

The guide below will give you the detail step by step to find the pay housing loan in lump sum option.

Step 1) Go to your housing mortgage loan provider – it could be HDB, it could be Bank or some other approved financial institutions (so for the sake of simplicity, let’s just call it “financier” on the rest of this article) and ask for partial Prepayment form – depending on the financier, you may get physical form or online form (let’s just call this form as “Housing Loan Partial Prepayment form”.

Step 2) Once you get your hands on the “Housing Loan Partial Prepayment form”, there are couple of important items you MUST read, understand and know.

a) Read the whole “Housing Loan Partial Prepayment form” including the terms and conditions. Make sure you understand all of what’s written on the form. In case there’s anything you are unsure of, don’t hesitate to call/come to your financier and get clarity.

b) Understand the implication – depending on your Housing Loan “package” you took, doing lump sum payment (or partial prepayment) may incur you a penalty fee.

c) Know what is the minimum lump sum payment acceptable and when you can make the lump sum payment – because some financier requires you to let them know in advance before making any lump sum payment.

Once you have read, understood and known the “Housing Loan Partial Prepayment form” and the implication, don’t fill in yet the form but rather continue to the steps below.

Step 3) Login to CPF website

Step 4) Once logged in to CPF website, you can either follow the steps below, or if you want to skip directly to step 10, click on the following URL: https://housing.cpf.gov.sg/hse/CPFHousing.xhtml (then jump to step 10).

Step 5) Click “Tools & Services”.

Step 6) On Tools & Services screen, find “Forms and e-applications” then click on “Find now”.

Step 7) On Forms and e-applications screen, go to “Home Ownership” section, click on “Use CPF to buy a home”.

Step 8) On Use CPF to buy a home screen, go to “Application to Use CPF Savings for Partial/Full Repayment of Housing Loan or Revision/Cessation of Monthly CPF Deduction of HDB Flat Financed with Bank Loan”. You will find text written as “FORM HBL/4”. Click “Apply online”. You’ll be redirected to “My Request” page.

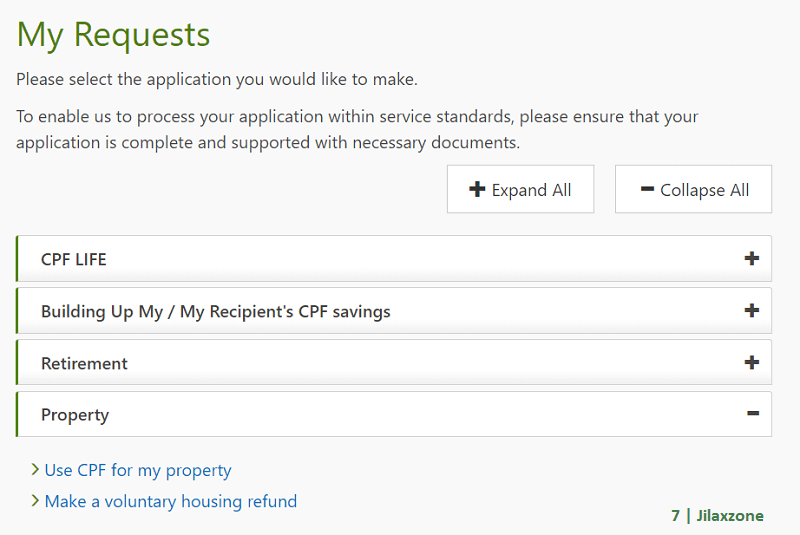

Step 9) On My Request screen. Click on “Property” to expand the contents, then click on “Use CPF for my property”. You’ll be redirected to Use CPF for my property page, under this URL: https://housing.cpf.gov.sg/hse/CPFHousing.xhtml.

Step 10) On Use CPF for my property screen, select your Property. Then click “Next”.

Step 11) On Property Address screen, under “Online Applications”, choose “Make Lump Sum Payment”. Then click “Next”.

Step 12) On Make Lump Sum Payment screen, do read the info provided and only if you are ok with the info provided, Then click “Start”.

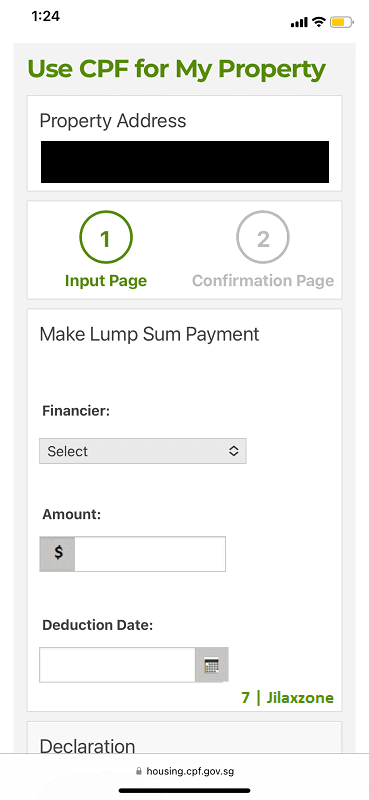

Step 13) On Make Lump Sum Payment – Input Page screen, fill in the following details:

a) Select your Financier.

b) Key in the amount you want to do lump sum payment. Some financier has certain minimum accepted lump sum payment amount, so be sure that you fulfill the financier criteria.

c) Set the Deduction Date. Some financier requires you to let them know in advance before making any lump sum payment, so be sure the Deduction date you set, follows the financier criteria.

d) Tick the I declare that tickbox, only and if only you have read, understand and agree with the terms and conditions.

Then click “Next”.

Step 14) On Make Lump Sum Payment – Confirmation Page screen, do check and verify all your input. If anything you would like to make changes, do click “Back”, otherwise click “Submit”.

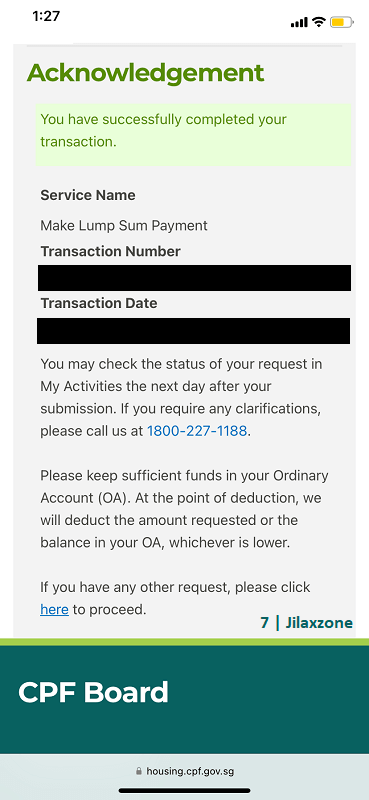

Step 15) On Acknowledgement screen, you’ll get a transaction number. Do take note on the transaction number and/or screenshot and store it somewhere safe, in case you need it. You may now log off from CPF website.

Step 16) Now since CPF website portion is done, let’s go back to the “Housing Loan Partial Prepayment form”. This time, fill in the form according to what you have submitted on CPF website, including but not limited to: the amount and the deduction date.

Step 17) Submit the “Housing Loan Partial Prepayment form” back to the financier (if it’s physical form) or click “Submit” (or something similar) (if it’s online form).

That’s it.

Bring it all together

You have just submitted your lump sum payment for your housing loan. Do ensure by the Deduction Date, you have enough amount on your CPF OA account, because otherwise the lump sum payment transaction would be cancelled. In case you have queries or are facing difficulties, don’t hesitate to put your issues or thoughts down below on the comment section. I’ll be happy to assist!

Interested to see other Singapore related tips and tricks? Check them out here:

Singapore in General: Singapore tips and tricks at JILAXZONE.

Singapore Tax related articles: Singapore Tax Savings articles at JILAXZONE.

Do you have anything you want me to cover on my next article? Write them down on the comment section down below.

Alternatively, find more interesting topics on JILAXZONE:

JILAXZONE – Jon’s Interesting Life & Amazing eXperience ZONE.

Hi, thanks for reading my curated article. Since you are here and if you find this article is good and helping you in anyway, help me to spread the words by sharing this article to your family, friends, acquaintances so the benefits do not just stop at you, they will also get the same goodness and benefit from it.

Or if you wish, you can also buy me a coffee:

Thank you!

Live to Share. Share to Live. This blog is my life-long term project, for me to share my experiences and knowledge to the world which hopefully can be fruitful to those who read them and in the end hoping to become my life-long (passive) income.

My apologies. If you see ads appearing on this site and getting annoyed or disturb by them. As much as I want to share everything for free, unfortunately the domain and hosting used to host all these articles are not free. That’s the reason I need the ads running to offset the cost. While I won’t force you to see the ads, but it will be great and helpful if you are willing to turn off the ad-blocker while seeing this site.